For the past few weeks I’ve been laser-focused on raising a round of capital for my seventh company, the Shift Group.

And having done this many times before, I thought I knew what I was doing.

That is, until I met up with Andrea Kihlstedt.

Andrea has been a fundraiser for non-profits for many years. And her exceptional success is deeply rooted in her interest in philosophy and psychology.

“Fundraising is the willingness to ask in a way that intersects with what the person you are asking wants,” starts Kihlstedt.

“If you do that, your chances go up in a big way!” she continues.

In fact, she promises, you can use this technique for any UnReasonable request you make of someone else: whether it is raising capital or getting your partner to take you out to dinner when you’re too tired to cook.

This is how most entrepreneurs ask for money from investors:

- Figure out what you are going to ask for

- Develop the presentation

- Make presentation to the person you are asking

- Listen for their objections

- Overcome their objections

- Make the deal

Sounds reasonable right?

But it usually doesn’t work. Because it creates objections. It is designed to deal with the anticipated resistance, the reasons to not do what you want them to do.

“The more you push someone, the more resistance you create,“ explains Kihlstedt.

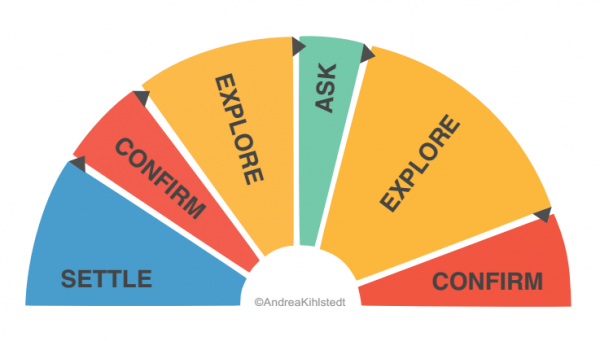

UnReasonable Fundraising Model: (adapted from How to Get Your Husband to Take You Out To Dinner, by Andrea Kihlstedt)

- Focus— get both you and the person you’re asking to invest focused on the conversation. Start with small talk, but keep it positive (no complaining!)

- Confirm—get clear on your purpose for the conversation: having the person invest in your company. Start with something like, “We set up this meeting to gauge your interest in my company. Do you still have 30 minutes?” Their answer might be something like, “OK, but I’ve got to be out the door by 4:30 sharp.”

- Engage— find out what is on your potential investor’s mind about financing your company. Instead of diving in and asking for the investment, try something like, “Have you ever invested in a start up and that really worked for you?” Make it about them, not about you. Their answer might be, “Not really. I’ve tried a couple of times, but in the end the entrepreneur just wasn’t ready or experienced. It’s a shame, because their concepts were solid.”

- Request— next, you must shape your request in the context of the potential investor’s desire. And remember, you must be flexible in making your request. Getting what you want from someone usually depends on your ability to shape your request in terms of what they want. You might say something like, “I completely understand the frustration, your wanting to help a startup, but not wanting to waste your time or money. That is exactly why I started my company… [explain].” Now for the ask: “So you can see, investing in our company gives you two things, 1) a company run by uber-experienced entrepreneurs and experts, and 2) access to quality deal flow in other companies. Would you like to explore what it would take to invest?”

- Explore—once your investor has indicated an interest in your project, you’ve got to discuss the specifics of the deal. In this step, you’ll figure out how you’ll work together and what the terms of his investment will be. Depending on how unreasonable the ask is, is how many next steps and time is involved to complete. The difference between asking someone for significant amounts of money for something that is not very liquid, versus asking someone to dinner, usually dictates the number and complexity of next steps. Get clear on the what’s and when’s.

- Confirm (again)—finally, you’ll confirm the deal you believe you’ve agreed on and spell out the plan clear and next steps. This final piece avoids unnecessary misunderstanding and sets a clear path for moving forward.

Kihlstedt reiterated to me, “Remember, for you to get that UnReasonable request for money granted, know exactly what you want and then be willing to give it up.

“I know it’s paradoxical, but if you’re willing to give it up, you’ll be much more likely to get it.”

I tried this the next day when speaking with a potential investor who manages angel groups in the DC area.

Before talking with Andrea, I thought his interest in what I was doing would be close to zero, since I am in NYC and he doesn’t invest outside of the DC Metro area.

Using Kihlstedt’s six steps, however, more than surprised me when the angel investor told me he was interested. We clarified the next steps and are now putting together the agreements.

Thank you, Andrea.